This judgment was handed down on 13 February 2025 and released to the National Archives for publication on 11 April 2025 following an agreed process of anonymisation and having regard to the recent guidance from the Honourable Mr Justice Peel that anonymised case names should not spell out discernible words.

HHJ Richard Williams:

Introduction

1. This is my judgment following the trial of preliminary issues in financial remedy proceedings.

2. For ease of reference, and with no disrespect intended, I shall refer to the family members by their anonymised names in this published judgment. Other terms have been anonymised including company and place names.

3. AB (the Applicant) was married to CD (the 1st Respondent), who is (i) the son of EF (the 2nd Respondent) and her late husband, EF-H , and (ii) the brother of GH (the 3rd Respondent).

4. The preliminary issues to be determined are as follows:

a. CD was the sole registered shareholder of GUTHRUM Limited ("GUTHRUM"). Shortly after he and AB separated, CD signed share transfers ("the Share Transfers"), whereby he transferred his shares in GUTHRUM 50% to EF and 50% to GH. In summary, the respective cases are

i. AB says that the Share Transfers were made with the intention of defeating her claim for financial relief and as such should be set aside;

ii. EF says that, at the time of the Share Transfers, GUTHRUM had no value such that there was never any intention to defeat AB's claim for financial relief and no consequential loss suffered. In any event, the Share Transfers were only made to regularise the position that CD had always held the shares in GUTHRUM on trust for EF. By mistake, GUTHRUM's accountant drafted the Share Transfers to EF and GH, rather than to EF alone. EF seeks a declaration that she is the sole beneficial owner of the shares in GUTHRUM;

iii. From the outset and throughout almost the entirety of these long running proceedings, CD was in agreement with AB's case. However, on the morning of the trial, CD made an application in the face of the court, and was granted permission, to amend his statement of case to support EF's case that he had always held the shares on trust for EF; and

iv. As a result of failing to comply with court directions, GH is debarred from advancing any positive case on this preliminary issue. He played no active part at the trial.

b. CD is the registered owner of BLACKSMITH Caravan Park and the adjoining family home at BLACKSMITH House (together "BLACKSMITH"):

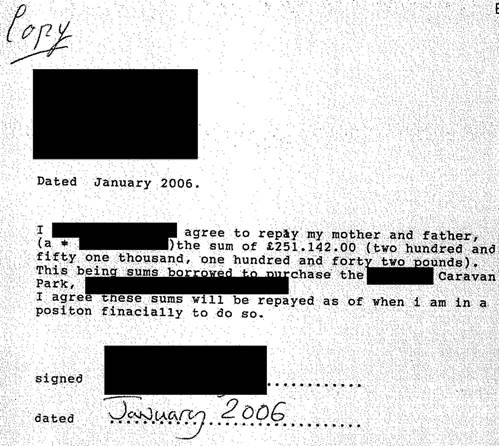

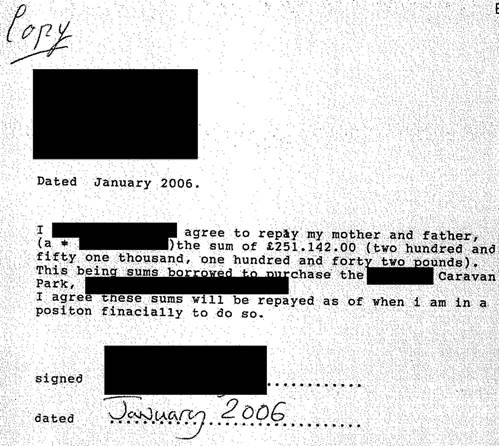

i. It is EF's case that she provided a loan to CD of £251,142 ("the Alleged Loan") towards the purchase of BLACKSMITH, which must be repaid;

ii. It is AB's case that there was no Alleged Loan or, if made, it has since been waived/forgiven/gifted; and

iii. It was CD's case initially that the Alleged Loan was statute-barred. However, in his amended statement of case, CD now accepts that the Alleged Loan must be repaid.

Background in more detail

5. Before an acrimonious falling out, the family owned and operated a very successful caravan park business comprising some 15 - 20 sites across three regions and a substantial trade in caravan refurbishment/sales. The business operated through multiple companies and partnerships. The companies participated in interest-free inter-company loans repayable on demand.

6. So far as is relevant to the present proceedings:

a. GUTHRUM carries on the business of owning and operating a residential caravan site ("GUTHRUM Park"). CD and EF were/remain co-directors, and CD was the sole registered shareholder on incorporation.

b. WINNIPEG Caravan Park Ltd ("WINNIPEG") carries on the business of owning and operating a residential caravan park. EF, EF-H and GH were co-directors and equal shareholders.

c. GLENOGIL Caravan Sales Limited ("GLENOGIL") carries on the business of trading in caravans and mobile/residential homes. EF, EF-H and GH, were co-directors and equal shareholders.

7. On 19 April 2019, AB and CD separated.

8. On 30 April 2019, CD transferred his shareholding in GUTHRUM 50% to EF and 50% to GH.

9. In May 2019, AB petitioned for divorce and made an application for financial orders under the Matrimonial Causes Act 1973 ("the 1973 Act").

10. Later that month, "GH became involved in ...... a heated discussion with CD. GH's wife, was concerned at developments and called the police. The act of calling the police was regarded by some in the family, particularly by EF, as an act which was not consistent with the family ethic of resolving matters themselves rather than involving outside agencies. The arguments between the brothers CD and GH, and between GH and his mother, EF, got worse."

11. In parallel litigation in the Business and Property Courts, GH pursued an unfair prejudice petition ("the Company Proceedings") and a partnership claim ("the Partnership Proceedings") against EF, which were subsequently concluded by way of:

a. On 19 November 2021, the amended unfair prejudice petition was struck out.

b. In May 2023, on the first day of the trial, the Partnership Proceedings were settled on confidential terms.

12. On 15 July 2020, AB made an application for an order pursuant to s.37 of the 1973 Act ("the Section 37 Application") that the Share Transfers be set aside on the ground that they were made with the intention of defeating her claim for financial relief.

13. On 23 September 2020, GH was removed as a director of GLENOGIL.

14. On 9 December 2020, GH was removed as a director of WINNIPEG.

15. By order dated 14 January 2021, GH was joined as a party and directed to file and serve any witness statement in response to the Section 37 Application by 26 February 2021.

16. By order dated 14 September 2021, GH was directed to file and serve (i) his statement of case in respect of the Section 37 Application and (ii) his witness statement in support, by respectively 28 October 2021 and 21 December 2021.

17. On 29 January 2022, GUTHRUM was served with statutory demands by WINNIPEG (£942,296.42) and by GLENOGIL (£126,024) in respect of outstanding inter-company loans.

18. By order dated 4 March 2022, GH was put on notice that, at the next hearing on 11 March 2022, the other parties would be seeking an order preventing him from pursuing a case on the Section 37 Application.

19. By order dated 11 March 2022, GH was debarred from pursuing a case on the Section 37 Application unless he filed and served (i) his statement of case in respect of the Section 37 Application and (ii) his witness statement in support, by respectively 28 March 2022 and 7 April 2022.

20. On 13 April 2022, EF-H died. As a consequence, EF became sole director of both GLENOGIL and WINNIPEG, whilst also effectively becoming the majority shareholder of both companies; 1/3rd in her personal capacity and 1/3rd as the personal representative of EF-H's estate.

21. On or about 28 April 2022, WINNIPEG applied on behalf of itself and GLENOGIL for an administration order in respect of GUTHRUM ("the Administration Proceedings"). In her witness statement in support of the application, EF explained that

"[39.] As a result of the family proceedings, there is a risk that control of GUTHRUM.... will pass to CD and/or his estranged wife. The Applicant and GLENOGIL... are not prepared to leave significant debts outstanding where this is a real possibility, nor continue to provide security and guarantees for RBS for [GUTHRUM's] outstanding loan to RBS. It is for this reason that the Applicant and GLENOGIL... have requested repayment of the outstanding debts..."

22. By order dated 5 May 2022, it was recorded that GH had failed to comply with the previous directions such that he was now debarred from pursuing a case on the Section 37 Application. It was ordered that the financial remedy proceedings, including the Section 37 Application, be stayed until the conclusion of the Administration Proceedings.

23. By order dated 27 July 2022 made in the Administration Proceedings, GUTHRUM was placed in administration, and Messrs P and T were appointed as joint administrators ("the Administrators").

24. The Administrators' proposals were dated 16 September 2022 and recorded the following:

a. assets largely comprising freehold land and buildings, which had been professionally valued, in the region of £3,950,000 to £4,400,000;

b. secured liability of £1,600,000 to Royal Bank of Scotland;

c. preferential liability of some £1,500 to HMRC;

d. unsecured claims totalling some £1,250,000, which sum included the claims of WINNIPEG and GLENOGIL, and a disputed claim by GH of £156,000 in respect of alleged management fees; and

e. notwithstanding that GUTHRUM was balance-sheet solvent, the Administrators took the view that there was insufficient working capital to discharge the debts, and so it was proposed that the business and assets be sold to produce a better result for GUTHRUM's creditors than would be achieved in liquidation.

25. On 8 October 2022, the Administrators' proposals were approved without modification by the deemed consent procedure pursuant to s.246ZF of the Insolvency Act 1986 ("the 1986 Act").

26. In April 2022, the Administrators began marketing GUTHRUM's business and assets for sale, which resulted in five offers ranging from £3,300,000 to £5,750,000 with the highest offer being made by GH.

27. On 18 July 2023, the Administrators applied in the Administration Proceedings for an order extending the administration period for one year. In her written evidence in response, EF opposed the application on the basis that such an extension was unnecessary, since GUTHRUM could be rescued as a going concern without the need for any extension having regard to her refinancing proposal. That proposal, in short, was that a special purpose vehicle, SPV(PA) Group Limited ("SPV(PA)"), was established and which would grant GUTHRUM a secured loan facility of £3,950,000. That facility would allow for (i) GUTHRUM's creditors to be paid in full, (ii) the surplus to be used as working capital, and (iii) GUTHRUM to be rescued as a going concern. The draft loan facility agreements provided for interest at 3% until the date of repayment (27.09.24) and 5% thereafter.

28. On 22 August 2023, WINNIPEG loaned £4 million to SPV(PA) for the purpose of making the onward loan to GUTHRUM.

29. On the 24 August 2023, I approved a draft consent order in the Administration Proceedings, which in summary provided for:

a. An extension of the administration.

b. A direction that the Administrators perform their functions (insofar as reasonably practicable) to achieve the objective of rescuing GUTHRUM as a going concern.

c. In the event that EF's proposed refinancing completed, a practical mechanism whereby the monies advanced be used to discharge all of GUTHRUM's liabilities and the administration costs and expenses.

d. A direction that the proposed refinancing did not complete before 14 days' notice of the order had been provided to GH. The rationale being that the Administrators wished to give GH the opportunity, if he wished, to put forward any alternative proposal and bearing in mind that he had already made an offer to buy the business and assets of GUTHRUM when he understood that the approved proposals were effectively a sale rather than preserving GUTHRUM as a going concern.

30. On 13 September 2023, GH applied in the Administration Proceedings under Paragraph 74 of Schedule B1 to the 1986 Act for a direction that the Administrators do not cause or authorise GUTHRUM to enter into the proposed loan, since it would cause unfair harm to his interests as a member of GUTHRUM ("the Insolvency Application").

31. On 27 September 2023, GH issued (i) an unfair prejudice petition pursuant to s.994 of the Companies Act 2006 ("the 2006 Act") alleging that, by lending £4 million of WINNIPEG's money to SPV(PA), EF was in breach of her director's duties to WINNIPEG by acting for her own purposes; and (ii) an application for an interim injunction ("the Injunction Application") restraining EF and SPV(PA) from paying away the £4 million pending determination of the unfair prejudice petition.

32. The Insolvency Application and the Injunction Application were heard together before me on 29 November 2023 when I reserved judgment.

33. By order dated 14 December 2023, the stay on the financial remedy proceedings was lifted, and it was directed that the Section 37 application be listed for hearing before me.

34. On 16 February 2024, I dismissed the Insolvency Application and the Injunction Application . In doing so, I determined amongst other things that:

"[52]...... It strikes me as unreal to proceed on the Insolvency Application by reference to GH's interests as a member when in short time there will be a hearing in the Financial Remedy Proceedings to determine the Section 37 Application, which determination will be binding upon GH. In light of the debarring order, there can realistically be only one of two outcomes either EF is the beneficial owner of the shares, or CD is the beneficial owner of the shares and in which case they are a financial resource available to meet AB's assessed reasonable needs. Therefore, the reality is that GH is pursuing the Insolvency Application without any legitimate interest as a member for doing so, but rather in an attempt to pursue his interest as a prospective purchaser of the site.

[53.] I am not satisfied that GH has standing to bring the Insolvency Application.

........

Risk that the loan is not repaid in full

[87.] Firstly:

a. GH argues that there are good reasons for thinking that GUTHRUM may be unable to repay SPV(PA) the £4 million. GH states in his written evidence that he expects GUTHRUM to be badly run by EF.

b. EF argues that she has adduced credible evidence of her ability to run GUTHRUM profitably and well. But even if that proved not to be the case, WINNIPEG's exposure to GUTHRUM's credit risk is short term, since the intention is for GUTHRUM to obtain long term refinancing from a commercial bank within 18 months.

c. GH argues that whether a bank would be prepared to provide substitute lending of £3.5 million to GUTHRUM after 18 months is speculative at best, and involves an unsafe assumption as to what value a bank would place on the site. If GUTHRUM is unable to repay SPV(PA) then SPV(PA) will be unable to repay WINNIPEG. It might be expected that GUTHRUM would be able to pay something to SPV(PA) even if put through an insolvency process, and that SPV(PA) might then be able to pay something to WINNIPEG even if SPV(PA) is itself put through an insolvency process. If, in the meantime, the court orders EF to buy GH's shares in WINNIPEG, it will have to estimate the amount that GUTHRUM would be able to repay SPV(PA), and SPV(PA) be able to repay to WINNIPEG. This exercise is likely to be difficult, and inherently uncertain.

d. EF argues that there is no reason to fear that WINNIPEG will not be repaid in full, since on GH's own case GUTHRUM's site is worth nearly £1.75 million in excess of the loan amount.

[88.] Ultimately, I consider that an analysis of the risk of default is academic for the purposes of the Injunction Application. By virtue of s.996 of the 2006 Act, the court has a wide discretion as to the nature of the relief to be granted in that it can "make such order as it thinks fit". That wide discretion extends to prescribing on a buy-out the method and assumptions for valuation including that the valuation be carried out on the basis of hypothetical factual assumptions seeking to put the petitioner back in the position that that they would have been had the unfairly prejudicial conduct not occurred in the first place.

[89.] Therefore, if the loan remains unpaid at the time of the trial of GH's unfair prejudice petition and the court finds EF's conduct has been unfairly prejudicial, the court can and no doubt will simply order that the valuation of GH's shares be calculated on the hypothetical assumed basis that WINNIPEG did not advance the £4 million to SPV(PA). There is no suggestion that EF would not be able to pay any such adjusted higher figure. Indeed, by her solicitors' letter dated 29 November 2023, EF made an offer to purchase GH's shares in WINNIPEG on the following terms:

a. The fair value of GH's shares be calculated as 1/3rd of the market value of WINNIPEG's total issued capital without any minority discount being applied.

b. The market value be calculated on the hypothetical assumed bases that

i. WINNIPEG did not advance the £4 million to SPV(PA); and

ii. WINNIPEG did not advance a director's loan to EF in the sum of £3.2 million.

c. In the absence of agreement, the fair value to be determined by a jointly instructed expert.

d. Each party to bear their own costs of the unfair prejudice petition, which was issued without EF having been given a reasonable opportunity to purchase GH's shares.

e. The offer to remain open for a period of 4 months.

[90.] This offer was expressed as an O'Neill v Phillips offer such that, if not accepted, GH's petition may fall to be struck out as an abuse of process in the event that the court was subsequently to conclude that continued prosecution of the claim would serve no useful purpose in that the offer cures the alleged prejudicial conduct by providing all the relief that GH could reasonably expect to obtain at the trial of the petition.

Prevented from buying GUTHRUM's site

[91.] Secondly, in his written evidence, GH states that: "Unless EF is stopped from using WINNIPEG's money to refinance GUTHRUM ..... [this will] prevent me buying the site at GUTHRUM... I do not think the court could adequately compensate me for my loss. It will be difficult for the court to calculate what that loss will be."

.........

[95.] In summary:

a. in order for a petition to be successful there must have been conduct that is unfairly prejudicial to the interest of the petitioner as a member of the subject company;

b. the requirement that conduct must be unfairly prejudicial to the interest of a member in his capacity as such must not be too narrowly construed albeit subject to limits; and

c. whilst unfairly prejudicial conduct can impact upon the interest of the petitioner beyond his capacity as a member of the subject company, that impacted interest must still be sufficiently connected to and bound up with his company membership.

[96.] In complaining that he will be prevented from buying GUTHRUM's site, GH is seeking to safeguard his personal interest as a potential purchaser of that site, rather than seeking to safeguard the financial worth of his investment in WINNIPEG. The prejudicial impact upon GH's interest as a potential purchaser of GUTHRUM's site is not sufficiently connected/bound up to his membership interests so far as they relate to WINNIPEG. Therefore, any difficulty over quantification does not arise because the loss of opportunity of GH buying GUTHRUM's site could not in any event found a claim for relief brought in connection with WINNIPEG pursuant to s.994 of the 2006 Act."

35. By order dated 6 June 2024 made in the Administration Proceedings, I directed that GH pay the additional costs and expenses of GUTHRUM incurred by virtue of it being in administration from the 13 September 2023 to 9 March 2024 ("the Additional Administration Costs") to be summarily assessed on the papers to be submitted pursuant to the assessment process provided therein.

36. By order dated 19 September 2024 made in the Administration Proceedings, I extended the period of the administration to 30 January 2025 because of continuing delays with the refinance monies being deposited with the solicitors. During the trial of the preliminary issues in the financial remedy proceedings, it was submitted on behalf of EF that, in the event, that the Share Transfers are set aside, EF will withdraw her offer of refinance.

37. By order dated 13 December 2024 made in the Administration Proceedings, I summarily assessed the Additional Administration Costs payable by GH in the sum of £91,957.

38. By order dated 23 January 2025 made in the Administration Proceedings, I further extended the period of the administration to 31 July 2025.

39. In preparation of this judgment:

a. I read and heard evidence from AB, CD and EF.

b. I read the written evidence of the jointly instructed experts

i. VAL-L, commercial property consultants; and

ii. VAL-C, forensic accounting and valuation services.

c. I read and heard submissions by counsel for each of AB, CD and EF.

Summary of the written evidence of the witnesses of fact

40. It was the written evidence of AB that:

a. After they were married, in 1999, AB and CD moved to live at AB-CD PARK, another park owned by EF, GH and EF-H. Whilst living there, they sold a number of units thereby generating a profit of around £798,000.

b. AB and CD decided that they wanted a more permanent and stable base for their young children and a business of their own. Therefore, in June 2006, they purchased for £625,000 in cash BLACKSMITH House and BLACKSMITH Carvan Park, which were registered in CD's sole name.

c. AB and CD had sufficient funds of their own, from buying and selling units, to purchase BLACKSMITH House and BLACKSMITH Caravan Park without any financial assistance from EF. The written loan agreement for £251,142 and disclosed by EF for the first time at the failed FDR, on 20 July 2020, is not genuine and has been generated by EF for the purposes of these proceedings.

d. In around June 2014, GUTHRUM Park came on the market. CD provided AB with a copy of the sales brochure. AB was excited but cautious due to the costs involved. However, CD reassured her that he was owed money from other family businesses, which would be used for the deposit, with the balance of the purchase costs being funded by way of a mortgage. There was existing planning permission to develop a further 19 units. Their plan was to develop all 19 units generating estimated profits of £100,000 - £120,000 per unit. Those profits would then be used to pay off the mortgage and to build their forever home on GUTHRUM Park.

e. CD explained he was the sole shareholder, and GUTHRUM was theirs. AB was not happy about EF being appointed a co-director, but CD explained that EF and GH had provided security as guarantors for the mortgage.

f. Throughout the marriage, AB worked in partnership with CD in developing their caravan parks by getting caravans ready for sale, dressing caravans, conducting viewings and running the businesses generally when CD was working on other family-owned parks.

g. AB did not find out about the Share Transfers until the failed FDR in July 2020. Whilst the Share Transfers took place on 30 April 2019, Companies House was not updated until the end of July 2019. Contradictory evidence has been given as to why the Share Transfers took place.

41. Initially, it was the written evidence of CD that:

a. In 2014 an opportunity came up to purchase GUTHRUM Park. EF mainly dealt with the negotiations over the purchase given she already owned a number of caravan parks in that part of the country.

b. GUTHRUM was set up with CD as the 100% shareholder, and with CD and EF as directors. EF gave CD 100% of the shares because she wanted to give him something of his own as he was suffering with depression and serious issues with his eyesight. EF wanted to ensure that CD had some financial security in case he lost his eyesight.

c. CD put no money whatsoever towards the purchase price of some £3 million for GUTHRUM Park. The finances were arranged by CD and EF through a commercial loan from RBS for £2.5 million, secured against the assets of GUTHRUM and WINNIPEG, and the balance by way of an intercompany loan from WINNIPEG.

d. EF took control of the financial side of the running GUTHRUM, whilst CD dealt with developing the site by constructing new roads and bases for static caravans, groundworks, installation of services and general improvements. CD undertook most of the labouring work himself. He also carried out the day to day tasks involved in running the site, which included arranging gas deliveries, general maintenance and upkeep. CD received no remuneration for his work in the business either by way of salary or dividends.

e. EF and GH were worried about the impact of the divorce on GUTHRUM. CD does not enjoy a good relationship with GH, who can be quite threatening and abusive. EF and GH took CD to a meeting with GUTHRUM's then accountant, ZAA. CD was told by the accountant, his mother and his brother, that he must sign over his shares in GUTHRUM otherwise he would lose them in the divorce and have nothing. Having initially refused, CD under pressure from his mother and brother eventually signed the Share Transfers feeling he had no alternative.

f. CD does not read very well, and did not read the documents before signing them. He and GH are not on good terms, and CD would never have agreed to signing his shares to GH. On reflection, because CD was forced by his mother and brother to transfer his shares to them, he now accepts that the Share Transfers should be set aside by the Court.

42. It was CD's updated written evidence that:

a. He no longer supports AB's application to set aside the Share Transfers.

b. If someone had asked him in 2018, for example, who actually owned GUTHRUM, CD would have said EF and his late father. His mum was much more involved but his father was alive then and they were in business together. CD did work on GUTHRUM Park, like he did in lots of the other parks.

c. The inter-company loans used to purchase GUTHRUM Park were made by family companies in which CD had no ownership interest. Also, the commercial mortgage was guaranteed against family companies in which CD had no interest. The BLACKSMITH Caravan Park was not used to provide any security.

d. When signing the Share Transfers, CD thought he was just signing off on some accounts. It was much later that GH told CD that he did not hold the share ownership of GUTHRUM. CD got mad with EF and GH for taking the shares away without telling him. It was more upsetting that 50% of the shares were in GH's name, and not 100% of the shares in EF's name (or his parents' names). CD and EF have a very bad relationship, and he would certainly not have signed over 50% of GUTHRUM to GH.

e. CD does not know what his thinking was at the time he made his earlier witness statement, but he was very angry with EF and GH about what had happened. With time passing, he can now see that the Share Transfers were just a practical business decision. However, at the time, he felt like he had been excluded from a family decision, which is why he was so angry.

43. It was the written evidence of EF that:

a. The family wealth and business interests have been accumulated through the hard work of EF and her husband, who have wanted to see their children succeed too.

b. EF helped CD purchase his own business, The BLACKSMITH Caravan Park, and his house, The BLACKSMITH, in 2006 by lending him the sum of £251,412. The former accountants (NU, RE & Co) drew up a loan agreement, which CD signed and in which he agreed to repay the loan when in a position financially to do so. AB knew about the loan as she and CD did not have the money to buy the site without it.

c. In 2014, GUTHRUM was incorporated at EF's instigation for the sole purpose of purchasing GUTHRUM Park, which was a site she identified and did the negotiations to secure the purchase. It was a park that for all intents and purposes was a property that EF, together with her husband, were acquiring. All of the purchase money was raised by them without any financial contribution by CD. GUTHRUM Park was purchased for the sum of £3,056,398.70, and which purchase was funded by way of -

i. An inter-company loan in the sum of £558,211.70 from WINNIPEG, which was majority owned by EF and her husband. CD had no interest in WINNIPEG and was not owed any money by WINNIPEG; and

ii. An RBS loan of £2.5 million secured against the assets of both GUTHRUM and WINNIPEG.

d. EF and her husband decided to give CD the opportunity to have some recognition to help him show his wife that he was worthy and for her to respect him more. EF and her husband therefore agreed that CD would be the sole shareholder of GUTHRUM but on the basis that they all agreed that EF and her husband were in truth the owners of GUTHRUM, which is why all the finances to buy GUTHRUM Park came from them. It was agreed and understood that CD was an owner in name only and this was the way in which the company was always run. EF was appointed a director of GUTHRUM and ran the company. CD's involvement has been by way of practical hands on work done from time to time to help out when needed, but he was not remunerated for that work in much the same way as GH, who also helped out.

e. AB knew at the time of purchase and has known throughout that in truth EF was the owner and controller of the business no matter whose name was on the door/ownership papers.

f. By March/April 2019, it was clear that CD was struggling physically and mentally. His health was deteriorating. He had problems with his eyes and was at risk of going blind. He wasn't getting treatment. He couldn't work. EF continued to run the business. What the accountant was advising made perfect sense due to CD's failing health and vulnerability. Therefore, it was agreed that the formal ownership of GUTHRUM would come back to EF and her husband. The Share Transfers were simply a reflection of what had been the case throughout namely the business was EF's and her husband's.

g. However, the Share Transfers went to EF and GH, which EF had not appreciated at the time. As has now become apparent from the parallel court proceedings, the transfer of shares to GH was organised and driven by the accountant, who was letting GH dictate that over and above EF's instructions.

44. I am unable in the course of this judgment to refer to all the evidence and argument relied upon by the parties, but I have taken it all into account in reaching my decisions.

Burden and Standard of proof

45. The legal burden rests upon the party making a claim to prove the facts essential to that claim.

46. By contrast, the evidential burden obliges the party upon whom that burden rests to adduce sufficient evidence, which if believed and if left uncontradicted and unexplained, could be accepted by the court as proof of the disputed fact. Usually the party who bears the legal burden also bears the evidential burden, although a party who would otherwise bear the evidential burden may be able to rely upon a rebuttable statutory presumption as to a particular matter - Phipson on Evidence 20th Ed. at paras 6-02 to 6-03.

47. This is not a Criminal trial where the standard of proof is beyond reasonable doubt so that I must be sure before making a finding of fact. Rather, I must apply the lower civil standard of proof being the balance of probabilities. In other words, in making a finding of fact, I must be satisfied that more likely than not it is true. In Re B [2008] UKHL 35, Baroness Hale said

"[32.] In our legal system, if a judge finds it more likely than not that something did take place, then it is treated as having taken place. If he finds it more likely than not that it did not take place, then it is treated as not having taken place. He is not allowed to sit on the fence. He has to find for one side or the other. Sometimes the burden of proof will come to his rescue: the party with the burden of showing that something took place will not have satisfied him that it did. But generally speaking a judge is able to make up his mind where the truth lies without needing to rely upon the burden of proof."

General observations upon the evidence of witnesses of fact

Indicators of unsatisfactory witness evidence

48. In Painter v Hutchinson [2007] EWHC 758 (Ch) at [3], Lewison J (as he then was) identified a non-exhaustive list of indicators of unsatisfactory witness evidence including:

a. Evasive and argumentative answers;

b. Tangential speeches avoiding the questions;

c. Blaming legal advisers for documentation (statements of case and witness statements);

d. Disclosure and evidence shortcomings;

e. Self-contradiction;

f. Internal inconsistency;

g. Shifting case;

h. New evidence; and

i. Selective disclosure.

Interference with memory

49. It is a striking feature of this case that the witnesses were seeking to recall events and conversations that took place many years ago, which necessarily gives rise to particular problems. Apart from the fact that, quite understandably, it is often difficult for witnesses to remember accurately what happened or what was said so long ago, witnesses can easily persuade themselves that the accounts they now give are the correct ones.

50. In Gestmin SGPS SA v Credit Suisse (UK) Limited [2013] EWHC 3560 (Comm), Leggatt J, as he then was, made the following observations about the interference with human memory introduced by the court process itself:

"[19.] The process of civil litigation itself subjects the memories of witnesses to powerful biases. The nature of litigation is such that witnesses often have a stake in a particular version of events. This is obvious where the witness is a party or has a tie of loyalty (such as an employment relationship) to a party to the proceedings. Other, more subtle influences include allegiances created by the process of preparing a witness statement and of coming to court to give evidence for one side in the dispute. A desire to assist, or at least not to prejudice, the party who has called the witness or that party's lawyers, as well as a natural desire to give a good impression in a public forum, can be significant motivating forces.

[20.] Considerable interference with memory is also introduced in civil litigation by the procedure of preparing for trial. A witness is asked to make a statement, often (as in the present case) when a long time has already elapsed since the relevant events. The statement is usually drafted for the witness by a lawyer who is inevitably conscious of the significance for the issues in the case of what the witness does nor does not say. The statement is made after the witness's memory has been "refreshed" by reading documents. The documents considered often include statements of case and other argumentative material as well as documents which the witness did not see at the time or which came into existence after the events which he or she is being asked to recall. The statement may go through several iterations before it is finalised. Then, usually months later, the witness will be asked to re-read his or her statement and review documents again before giving evidence in court. The effect of this process is to establish in the mind of the witness the matters recorded in his or her own statement and other written material, whether they be true or false, and to cause the witness's memory of events to be based increasingly on this material and later interpretations of it rather than on the original experience of the events."

Importance of corroborating contemporaneous documents, if available

51. In The Ocean Frost [1985] 1 Lloyd's Rep 1, Robert Goff LJ observed (and which observation was described as "salutary" by Lord Mance in Central bank of Ecuador v Conticorp SA [215] UKPC 11 at [164]):

"[57]................................... It is frequently very difficult to tell whether a witness is

telling the truth or not; and where there is a conflict of evidence such as there was in the present case, reference to the objective facts and documents, to the witnesses' motives, and to the overall probabilities, can be of very great assistance to a Judge in ascertaining the truth."

52. Similarly, in Gestmin SGPS SA v Credit Suisse (UK) Limited, Leggatt J, having commented upon the unreliability of human memory, concluded that:

"[22.] In the light of these considerations, the best approach for a judge to adopt in the trial of a commercial case is, in my view, to place little if any reliance at all on witnesses' recollections of what was said in meetings and conversations, and to base factual findings on inferences drawn from the documentary evidence and known or probable facts. This does not mean that oral testimony serves no useful purpose - though its utility is often disproportionate to its length. But its value lies largely, as I see it, in the opportunity which cross-examination affords to subject the documentary record to critical scrutiny and to gauge the personality, motivations and working practices of a witness, rather than in testimony of what the witness recalls of particular conversations and events. Above all, it is important to avoid the fallacy of supposing that, because a witness has confidence in his or her recollection and is honest, evidence based on that recollection provides any reliable guide to the truth."

Adverse Inferences

53. The court may draw adverse inferences from the failure of a party (i) to produce contemporaneous documents that would have otherwise existed and supported their case, and/or (ii) to call as a witness at trial a person who might be expected to give important evidence.

54. In Re: Mumtaz Properties Ltd [2011] EWCA Civ 610, Arden LJ said:

"[14] In my judgment, contemporaneous written documentation is of the very greatest importance in assessing credibility. Moreover, it can be significant not only where it is present and the oral evidence can then be checked against it. It can also be significant if written documentation is absent. For instance, if the judge is satisfied that certain contemporaneous documentation is likely to have existed were the oral evidence correct, and that the party adducing oral evidence is responsible for its non-production, then the documentation may be conspicuous by its absence and the judge may be able to draw inferences from its absence."

Subsequent conduct

55. In Carmichael and another v National Power Plc [1999] 1 WLR 2042, the House of Lords held that the Industrial Tribunal had been entitled, when determining as a question of fact whether a contract of employment had been agreed between the parties, to have regard to the parties' subsequent conduct. In so deciding, Lord Hoffman said this (at [2050H], and with my emphasis added):

".......In the case of a contract which is based partly upon oral exchanges and conduct, a party may have a clear understanding of what was agreed without necessarily being able to remember the precise conversation or action which gave rise to that belief. As the Court of Appeal pointed out, the tribunal did not make any specific findings about what was said at the interviews or on any other occasion. But the terms of the engagement must have been discussed and these conversations must have played a part in forming the views of the parties about what their respective obligations were.

The evidence of a party as to what terms he understood to have been agreed is some evidence tending to show that those terms, in an objective sense, were agreed. Of course the tribunal may reject such evidence and conclude that the party misunderstood the effect of what was being said and done. But when both parties are agreed about what they understood their mutual obligations (or lack of them) to be, it is a strong thing to exclude their evidence from consideration. Evidence of subsequent conduct, which would be inadmissible to construe a purely written contract (see Whitworth Street Estates (Manchester) Ltd. v. James Miller and Partners Ltd. [1970] A.C. 583) may be relevant on similar grounds, namely that it shows what the parties thought they had agreed. It may of course also be admissible for the same purposes as it would be if the contract had been in writing, namely, to support an argument that the terms have been varied or enlarged or to found an estoppel."

Lucas Direction

56. I remind myself that witnesses can often lie and for different reasons. Lies in themselves do not necessarily mean that the entirety of the evidence of a witness should be rejected. A witness may lie because of fear of the truth, misplaced sense of loyalty, torn loyalties, or in a stupid attempt to bolster a case, but the actual case nevertheless remains good irrespective of the lie. A witness may lie because the case is a lie.

Assessment of the witnesses of fact in this case

57. I consider that much of the witness evidence of fact was tainted to a material extent by indicators of unsatisfactory witness evidence. I will refer when relevant to those indicators later in this judgment when considering specific issues, but, in the meantime, give some other examples.

AB

58. Shifting evidence - AB, consistent with her written evidence, said in her oral evidence that she was actively involved in the business, which was a massive enterprise with the whole of the family acting as a team. AB assisted her husband working across multiple sites. However, in her Form E, AB had earlier stated that:

a. "I enjoyed an incredibly high standard of living, I have never been required to work, I wanted for nothing."

b. "I have no earning capacity, I have always been provided for by [CD] therefore I believe that it is a case for joint lives maintenance".

In her oral evidence, AB unconvincingly sought to explain away this contradiction by saying that, although she had assisted in the business, she had not worked. However, again in her Form E, when asked to detail "any particular contributions to the family property and assets...that have been made by you", AB simply left that section of the form blank.

59. Inconsistencies:

a. AB said in her oral evidence that, if EF had made a loan to help purchase BLACKSMITH, CD would have told her about it but he did not. However, earlier in her oral evidence, AB accepted that she was not privy to all the discussions between CD and EF.

b. In her written evidence, AB said that they did not need a loan from EF because they had generated profits of around £798,000 from the sale of various units. However, in her oral evidence AB variously said that CD was in control of everything, she did not know if he had paid tax on the sales, some sales went through the accounts, some sales did not go through the accounts, and she had not seen the accounts in any event, all of which meant it was difficult to understand the basis of her belief that such a level of profits had ever been generated.

CD

60. Shifting case:

a. In his Defence, endorsed with a statement of truth, CD stated that

"[7.] It is averred that [EF] agreed to the entire issued share capital [of GUTHRUM] being vested in [CD] in recognition of his efforts in identifying the land and facilitating its purchase as [the] land was at all times intended to belong to [CD]. Additionally, in agreeing to the entire issued share capital being vested in [CD], [EF] was motivated by her desire to provide [CD] with financial security.

.......

[9.] It is averred that the signature of [CD] in relation to the [Share Transfers] was procured by [EF] and [GH] in the following circumstances:

....

(b)] In April 2020, [CD] was invited by [EF] and [GH] to a meeting at the offices of Z-Accountants [(GUTHRUM's former accountants)] at which meeting [CD] was coerced by [EF] and [GH] into signing documentation by informing him, inter alia, that if he did not sign over the issued share capital he would lose them during the divorce."

b. In his Amended Defence, also endorsed with a statement of truth, CD stated that

" [7.] It is averred that [EF] agreed to the entire issued share capital [of GUTHRUM] being vested placed in the name of in [CD] in support of his standing within the family recognition of his efforts but it was always intended that [EF] (along with her husband) was going to be the owner of the shares....

[8.] ..... the shareholding was transferred without his knowledge, save that [CD] accepts that the ultimate owners of [GUTHRUM] were his parents."

c. CD's explanation for his extraordinarily late and stark change of case was that, until relatively recently, he had been consumed with anger that GH was trying to steal shares in GUTHRUM that belonged to his mother and father. However, that explanation made absolutely no sense.

d. In her Particulars of Claim dated October 2021, EF had claimed that:

"[3.] On 21 July 2019 Z-Accountants....([GUTHRUM's] former accountants) erroneously transferred the entire issued share capital as to:-

• 50 to [GH], and

• 50 to [EF].

The entire issued share capital was to be transferred to [EF] and her husband.

[4.] [GUTHRUM] is the subject of a dispute in the...Business and Property Courts.... [between GH and EF] and in which [EF] contends while GH is the legal owner of 50% of the shares....in [GUTHRUM], he holds such shares on trust for EF alone.... and he is hereby required to transfer the shares that he holds in [GUTHRUM] to EF.

[5.] By resolution of the board of directors of [GUTHRUM] passed on 5 May 2020 Z-Accountants['s]... appointment as accountants for [GUTHRUM] was terminated...."

e. At the time Z-Accountants' appointment was terminated, CD remained a director of GUTHRUM. However, even if as an officer of the company he was not then aware of the reason for Z-Accountants appointment being terminated, CD must have known by the time of EF's Particulars of Claim, over 3 years ago, that it was EF's case that the Share Transfers drafted by Z-Accountants were wrongly drafted by transferring any shares to GH. If CD was genuinely consumed with anger that GH was trying to steal his parents' shares then he could simply have admitted EF's claim in his Defence, but rather he chose to deny it and maintain that denial until the very last moment.

61. Inconsistencies:

a. CD failed to disclose the Alleged Loan as a liability in his Form E. In his oral evidence, he sought to blame his former solicitors for the omission.

b. CD said in his oral evidence that AB knew about the Alleged Loan prior to the FDR. However, he then said that he did not discuss finances with AB during the marriage. When asked therefore how it was that AB knew about the Alleged Loan, he unconvincingly sought to claim that she overheard him talking about it on the phone.

c. In his Form E, CD stated that the standard of married living was "Very good. I worked very hard to provide for my family. [AB] chose not to work. We had whatever we wanted including nice cars, expensive jewellery for [AB] and other material things. We enjoyed regular holidays abroad including Dubai each year and all inclusive holidays to Spain and Cyprus." In his oral evidence, when asked why he had chosen to pay for expensive holidays over repaying the Alleged Loan, CD then claimed that they went on holidays, but they were not expensive, as they could not afford them.

d. In his oral evidence, CD said that he and AB separated many years before the Share Transfers were made. When it was pointed out to him that in his written evidence he had accepted that they had separated "only a few weeks beforehand", CD then said he could not remember when they separated.

62. Contradiction - In his written evidence, CD stated that he was told by Mr ZAA, EF and GH to sign the Share Transfers or he would lose them in the divorce. However, in his oral evidence, he claimed that was never said or he could not remember that being said.

EF

63. Inconsistencies:

a. In her oral evidence, EF said that at the time of the Share Transfers:

i. She had not given much thought either to the separation of AB and CD or to the potential financial claims of AB; and

ii. She did not discuss them with CD as she was too busy with other matters. In particular, she did not remember saying that CD would lose GUTHRUM in the divorce if he did not transfer the shares away.

The impression given by EF was that she had been uninterested in the impact that the divorce might have upon the ownership of GUTHRUM.

b. However, on 28 January 2022, EF signed the minutes, as Chairperson, of the meetings of the boards of directors of WINNIPEG and GLENOGIL. The minutes are in the same terms and record (with my emphasis added)

"[4.2] The Chairperson reported that one of the directors of GUTHRUM, CD , was subject to matrimonial proceedings..... As a result of the claims being made by AB.. in those Proceedings, there is a realistic prospect that the ownership and management of GUTHRUM may change and that there was a significant risk that the Intra-group Loan would not be repaid or refinanced when demanded.

[5.] RESOLUTION

In the light of the matters reported to the meeting, the Board resolved that there was a significant risk that the Inter-group Loan would not be repaid when demanded and that it was in the best interests of the Company to demand the immediate repayment of the Intra-group Loan now and to take steps to enforce the repayment of the Intra-group Loan should payment not be immediately forthcoming following the making of the demand.

[6.] BOARD'S INSTRUCTIONS

The Board instructed the Chairperson to take immediate steps to demand the immediate repayment of the Intra-group Loan and if necessary seek the services of the Company's solicitors to assist with the making of the demand and enforcing repayment of the Intra-group Loan."

c. Those minutes record that EF sought to enforce the inter-company loans to protect the interests of WINNIPEG and GLENOGIL because of concerns over the solvency of GUTHRUM upon a change of ownership arising from the financial remedy proceedings. However, EF has nevertheless spent significant time and money in:

i. defending the Section 37 Application and despite her case that the shares in GUTHRUM had/have no financial value; and

ii. seeking to rescue GUTHRUM as a going concern from the very Administration that EF chose to trigger through her control of WINNIPEG and GLENOGIL and by enforcing the inter-company loans. Indeed, EF's proposed company rescue is being financed effectively through a replacement inter-company loan from WINNIPEG in the sum of some £4 million, which is over 4 x the amount of WINNIPEG's original inter-company loan and which EF had decided to enforce because of concerns over GUTHRUM's ability to repay/refinance that substantially smaller loan.

64. Blaming advisers for documentation - EF repeatedly sought to blame advisers for the contents of documents, which were inconsistent with her case. For example, in her third witness statement dated 8 August 2023 filed in the Administration Proceedings, EF stated (at para 7.) that "the Joint Administrators' valuers had valued [GUTHRUM Park] at £3.95 million...... [which] meant that [GUTHRUM] was no longer balance sheet insolvent contrary to valuations that I had obtained." In her oral evidence, EF said that those words had been included in the witness statement without her knowledge. Later in that same witness statement, EF stated (at para 16.) that "I expect that [post administration GUTHRUM] will be able to generate over £290,000 of turnover from rent, commissions, rates and utilities." Again in her oral evidence, EF said that she did not know who wrote those words, but they were not her words. She then said that GUTHRUM was not and would not be profitable. Ultimately, EF was simply unable to reconcile the fact that she is pursuing inconsistent parallel cases in two different courts albeit now before the same judge:

a. In the Administration Proceedings, it is EF's case that GUTHRUM is balance sheet solvent and will be highly profitable once the proposed company rescue has been completed.

b. In the Section 37 Application, it is EF's case that GUTHRUM has no commercial value and she is only pursuing the company rescue for sentimental reasons and in the memory of her late husband, who loved GUTHRUM Park. Although, if EF-H loved GUTHRUM Park so much, it then begs the question why did he ever agree as co-director to pass the resolutions in January 2022 to enforce the inter-company loans and thereby put GUTHRUM into administration in the first place.

It was argued that the family are a travelling family and whilst EF may be an impressive businesswoman, literacy is not a high priority. Therefore, when legal documentation is required, the family rely heavily on their advisers to ensure that their position is protected. Whilst that is likely true, I cannot and do not accept that professional advisers would have drafted the contents of legal documents without EF's express instructions and her full knowledge of the contents.

Overall approach to findings of fact in this case

65. In my assessment:

a. AB was not a reliable witness.

b. CD and EF were neither reliable nor at times honest witnesses.

66. In addition, AB, CD and EF were not detached or objective observers. They were subject to significant motivating forces and powerful biases:

a. They all have a financial interest in the outcome of the case.

b. It is not unusual for cases involving family disputes to generate strong feelings on both sides of the argument. However, a striking feature of this case and indeed the wider litigation was the extreme and deep-seated feelings of anger, resentment, betrayal and bitterness that have been generated amongst this family following the breakdown in relations, which has pitched brother against brother, mother against son, husband against wife, and mother against daughter-in-law. By way of illustration -

i. I have viewed the video of an ugly confrontation between AB and EF outside BLACKSMITH. As I observed during the hearing, it was a particular concern that AB and EF each felt able to make such derogatory comments about the other in the presence of AB's daughter/EF's granddaughter; and

ii. In parallel non-molestation proceedings, which were ultimately compromised by way of cross-orders, AB and CD made serious allegations against each other of abusive and threatening behaviour.

67. For all these reasons, I have approached the evidence of all the witnesses of fact with a substantial degree of caution. I am unable safely to accept their evidence unless it is corroborated by other reliable evidence, or is contrary to their own interests.

68. In making my findings of disputed facts in this case, I have had particular regard to what the parties have subsequently said and done, the undisputed facts, the inferences properly to be drawn from those undisputed facts and any missing relevant evidence, the contents of the reliable contemporary documents, and the overall probabilities including by reference to the parties' motives.

The Share Transfers

Statutory framework

69. Section 37 of the 1973 Act provides (so far as relevant) that:

"(2) Where proceedings for financial relief are brought by one person against another, the court may, on the application of the first-mentioned person

.......

(b) if it is satisfied that the other party has, with that intention, made a reviewable disposition and that if the disposition were set aside financial relief or different financial relief would be granted to the applicant, make an order setting aside the disposition;

.........

and an application for the purposes of paragraph (b) above shall be made in the proceedings for the financial relief in question.

......

(4) Any disposition made by the other party to the proceedings for financial relief in question (whether before or after the commencement of those proceedings) is a reviewable disposition for the purposes of subsection (2)(b) above unless it was made for valuable consideration (other than marriage) to a person who, at the time of the disposition, acted in relation to it in good faith and without notice of any intention on the part of the other party to defeat the applicant's claim for financial relief.

(5) Where an application is made under this section with respect to a disposition which took place less than three years before the date of the application ...... and the court is satisfied

(a) in a case falling within subsection (2) ... (b) above, that the disposition or other dealing would (apart from this section) have the consequence....

.......

of defeating the applicant's claim for financial relief, it shall be presumed, unless the contrary is shown, that the person who disposed of ....... the property did so ....... with the intention of defeating the applicant's claim for financial relief."

70. In Kremen v Agrest and Fisherman [2010] EWHC 2571 (Fam), Mostyn J summarised the statutory test as follows in the context of a charge entered into over the family home:

"[8] This is the Part III counterpart to the more familiar s 37 of the MCA 1973. It is entitled 'Avoidance of transactions intended to defeat applications for financial relief'.

[9] For W's application to succeed the following has to be demonstrated:

(i) That the execution of the charge was done by H with the intention of defeating her claim for financial relief. This is presumed against H, and he has to show that he did not bear that intention....... The motive does not have to be the dominant motive in the transaction; if it is a subsidiary (but material) motive then that will suffice: see Kemmis v Kemmis (Welland and Others Intervening), Lazard Brothers and Co (Jersey) Ltd v Norah Holdings Ltd and Others [1988] 1 WLR 1307, [1988] 2 FLR 223.

(ii) That the execution of the charge had the consequence of defeating her claim. This means preventing relief being granted, or reducing the amount of any such relief, or frustrating or impeding the enforcement of any order awarding such relief......

(iii) That the court should exercise its discretion to set aside the charge......."

Defeating AB's claim for financial relief?

71. AB argues that:

a. The valuation of VAL-C, the jointly instructed accountancy expert, is contested and in any event is now historical.

b. GH has made an offer to purchase the business and assets of GUTHRUM for

£5.75 million and has pursued highly contested (and expensive) litigation to try and force his offer to be accepted.

c. EF appears to accept that VAL-C's valuation is wrong, since, in her third witness statement dated 8 August 2023 in the Administration Proceedings, EF stated that:

"[8.] Whilst it may be said to look odd that WINNIPEG and GLENOGIL, who applied and supported the appointment of the Joint Administrators, are now objecting to the extension of the administration it is important to set out the context.

[9.] On receipt of the draft sales particulars from the Joint Administrators (based on their new valuation of £3.95million), it became apparent that the rescue of [GUTHRUM] was possible........

[25.] I recognise that on a sale of the site for the figure put forward by GH there would be a return to shareholders of approximately £1.35 million each (£2.7 million in total), however there are a number of reasons why retaining [GUTHRUM] as a going concern is more valuable than this outcome:

.......

e. ..........Whilst at the time of WINNIPEG making the application for administration it felt like I had little other option (the position of the Company based on the earlier valuation meant I needed to consider the best interests of WINNIPEG and GLENOGIL as its creditors) that is now not the situation, and if there is any opportunity to rescue [GUTHRUM] without selling its site (as I now believe there is) then this would be a much better outcome."

d. In all the circumstances, it is clear that AB has been right all along that GUTHRUM has always had a substantial value.

72. EF argues that there is an abundance of evidence, which is not challenged by AB, which demonstrates that the shares in GUTHRUM had no value in 2019 such that the Share Transfers did not have the consequence of defeating AB's claim for financial relief:

a. VAL-C expressed the opinion in his report dated 11 March 2022, that "I do not consider any value can be attributed to [CD's] 100% shareholding in [GUTHRUM] as at the 2019 valuation date". AB has not sought to challenge VAL-C's report, either in writing or orally, and so it must stand.

b. There is corroborating valuation evidence from GUTHRUM's former accountant, Mr ZAA, who in the Administration Proceedings provided a witness statement dated 2 November 2023 in support of GH. Mr ZAA stated that "[18.] ....At the time [of the Share Transfers], the overall value of [GUTHRUM] was negligible. Although the park had value, this was offset by its bank borrowing, intercompany liabilities and provisions."

73. In closing arguments, I was referred to the Court of Appeal decision in Griffiths v TUI (UK) Limited [2021] EWCA Civ 1442. I was not referred to the decision of the Supreme Court in TUI UK Ltd (Respondent) v Griffiths (Appellant) [2023] UKSC 48, which decision I only became aware of after I had circulated my draft written judgment. The Supreme Court overturned the Court of Appeal and held that the trial judge was wrong (i) to allow the defendant to make detailed criticisms of the report of the claimant's expert, and (ii) to accept those submissions. By doing so the trial judge denied the claimant a fair trial. Lord Hodge said this:

"[36.] In this judgment I address civil proceedings and leave to one side questions of criminal procedure. It is trite law that as a generality in civil proceedings, the claimant bears the burden of proof in establishing his or her case. It is trite law that the role of an expert is to assist the court in relation to matters of scientific, technical or other specialised knowledge which are outside the judge's expertise by giving evidence of fact or opinion; but the expert must not usurp the functions of the judge as the ultimate decision-maker on matters that are central to the outcome of the case. Thus, as a general rule, the judge has the task of assessing the evidence of an expert for its adequacy and persuasiveness. But it is trite law that English law operates an adversarial system, and the parties frame the issues for the judge to decide in their pleadings and their conduct in the trial. It is also trite law that, in that context, it is an important part of a judge's role to make sure that the proceedings are fair. At the heart of this appeal lies the question of the requirements of a fair trial.

........

[70.] .......

(i) The general rule in civil cases, as stated in Phipson, 20th ed, para 12-12, is that a party is required to challenge by cross- examination the evidence of any witness of the opposing party on a material point which he or she wishes to submit to the court should not be accepted. That rule extends to both witnesses as to fact and expert witnesses.

........

(vii) The rule should not be applied rigidly. It is not an inflexible rule and there is bound to be some relaxation of the rule, as the current edition of Phipson recognises in para 12.12 in sub-paragraphs which follow those which I have quoted in para 42 above. Its application depends upon the circumstances of the case as the criterion is the overall fairness of the trial.....

.........

[71.] In assessing the fairness of the trial in this case it is important to have regard to the approach which TUI's legal team adopted in response to the claim. TUI in its defence put Mr Griffiths to proof of his claim. TUI chose not to lodge the report of an expert microbiologist, which it obtained. That report might have put forward a case on causation which differed from that of Professor Pennington. TUI failed to lodge the report of their expert gastroenterologist in a timely manner and called no witnesses as to fact. The CPR Pt 35.6 questions, which I have set out in para 14 above, were not clearly focused on the matters which were the objects of criticism in counsel's submissions and did not put Professor Pennington on notice of those criticisms. TUI chose not to request that Professor Pennington be made available for cross-examination. TUI's challenge to his evidence was not intimated to Mr Griffiths' legal team until the submission of its skeleton arguments on the eve of the trial, by which time it would have been too late for them to seek to have him attend to give evidence.

.......

[75.] ....... In the absence of a proper challenge on cross-examination it was not fair for TUI to advance the detailed criticisms of Professor Pennington's report in its submissions or for the trial judge to accept those submissions."

74. The Supreme Court decision in TUI UK Limited does not cause me to change my view that I am entitled in the present case to evaluate the written evidence of the jointly instructed experts. There is no unfairness in me doing so in circumstances where AB sought to challenge that evidence prior to trial. Once the stay had been lifted, AB applied at the Pre-Trial Review hearing on 4 April 2024 for permission to obtain updated valuations. That application was actively opposed by EF. I dismissed the application because I did not consider updated valuations would assist me when the Administrators had in the meantime successfully marketed GUTHRUM Park for sale on the open market. The rule in TUI UK Limited is described by the Supreme Court as being flexible, and its application depends upon the particular circumstances of the case. The circumstances in TUI UK Limited, including the litigation conduct of the defendant, were very different to and distinguishable from the circumstances in the present case.

75. Ultimately, I must assess the expert evidence to see what assistance can be derived from it and viewed in the context of the circumstances of the case as a whole, although I should not depart from it without good reason particularly where the evidence is from a single joint expert.

76. It is well established that expert valuations of private companies are notoriously fragile and should be treated with caution. In Martin v Martin [2018] EWCA Civ 2866, Moylan LJ said:

"[90.] Where do valuations of a private company fall in this spectrum? The first point to recognise is that this can, of course, vary depending on the facts of the case. In Wells v Wells and Versteegh v Versteegh the trial judge, respectively, had been unable to value the shares "with any reasonable precision" (Thorpe LJ at [7]) and had been "unable to reach a safe valuation" (Lewison LJ at [193]) because of the uncertainties present in those cases. It might be, in contrast, that, as suggested in White v White, the company can be valued by reference to its assets which are, in themselves, capable of being securely valued.

[91.] Subject to that introduction, how should family courts approach valuations of private companies, in particular trading companies? This general issue has very recently been considered by this court in Versteegh v Versteegh. The conclusion and guidance given were that such valuations need to be treated with caution. Although in my view the guidance is clear, given the arguments in the present case I propose to quote at some length from that case which in turn quoted what I had said, sitting at first instance, in H v H [2008] 2 FLR 2092. King LJ said:

"[136] In H v H [ 2008] 2 FLR 2092 Moylan J highlighted the fact that the vulnerability of valuations had been specifically recognised by the House of Lords in Miller v Miller; McFarlane v McFarlane: [2006] UKHL 24, [2006] 1 FLR 1186. Moylan J said:

"[5] The experts agree that the exercise they are engaged in is an art and not a science. As Lord Nicholls said in Miller v Miller; McFarlane v McFarlane [2006] 2 AC 618 [26]: "valuations are often a matter of opinion on which experts differ. A thorough investigation into these differences can be extremely expensive and of doubtful utility". I understand, of course, that the application of the sharing principle can be said to raise powerful forces in support of detailed accounting. Why, a party might ask, should my "share" be fixed by reference other than to the real values of the assets? However, this is to misinterpret the exercise in which the court is engaged. The court is engaged in a broad analysis in the application of its jurisdiction under the Matrimonial Causes Act, not a detailed accounting exercise. As Lord Nicholls said, detailed accounting is expensive, often of doubtful utility and, certainly in respect of business valuations, will often result in divergent opinions each of which may be based on sound reasoning. The purpose of valuations, when required, is to assist the court in testing the fairness of the proposed outcome. It is not to ensure mathematical/accounting accuracy, which is invariably no more than a chimera. Further, to seek to construct the whole edifice of an award on a business valuation which is no more than a broad, or even very broad, guide is to risk creating an edifice which is unsound and hence likely to be unfair. In my experience, valuations of shares in private companies are among the most fragile valuations which can be obtained."

[137] Moylan J was referring to a business valuation, as was the Court of Appeal in Wells v Wells. Here the court is more specifically concerned with valuations relating to property developments. For the reasons given by Lewison LJ at [184] - [195], the same principle found in Miller and H v H applies as much to development land valuation as to conventional business valuations, perhaps even more so given the dramatic effect that even a small adjustment in a variable can make to a valuation and given the inherent unpredictability, described by Lewison LJ, in relation to property development projects."

Lewison LJ said:

"[185] The valuation of private companies is a matter of no little difficulty. In H v H [2008] EWHC 935 (Fam), [2008] 2 FLR 2092 Moylan J said at [5] that "valuations of shares in private companies are among the most fragile valuations which can be obtained." The reasons for this are many. In the first place there is likely to be no obvious market for a private company. Second, even where valuers use the same method of valuation they are likely to produce widely differing results. Third, the profitability of private companies may be volatile, such that a snap shot valuation at a particular date may give an unfair picture. Fourth, the difference in quality between a value attributed to a private company on the basis of opinion evidence and a sum in hard cash is obvious. Fifth, the acid test of any valuation is exposure to the real market, which is simply not possible in the case of a private company where no one suggests that it should be sold. Moylan J is not a lone voice in this respect: see A v A [2004] EWHC 2818 (Fam), [2006] 2 FLR 115 at [61] - [62]; D v D [2007] EWHC

278 (Fam) (both decisions of Charles J)."

[92.] Given the proximity of the decision in Versteegh v Versteegh, and also, as it happens, given that my views have not changed from what I said in H v H, I can see no reason why we should depart from the conclusions and guidance set out in the former, namely that valuations of private companies can be fragile and need to be treated with caution. Further, it accords with long-established guidance and, I would add, financial reality."

77. In all the circumstances, I am unable and do not attach weight to the expert valuations in the present case and for the following reasons:

a. VAL-C valued GUTHRUM at the time of the Share Transfers on 30 April 2019 on the basis of GUTHRUM's net assets "adjusted to include the market value of the site at GUTHRUM Park, per the valuation report prepared by VAL-L" being £2,486,000 (as at 14 October 2021) and giving net liabilities of £370,496. Therefore, the accuracy of VAL-C's valuation is entirely reliant upon the accuracy of the land valuation by VAL-L.

b. VAL-L produced 2 land valuations as at 18 March 2020 (£2,042,000), and as at 14 October 2021 (£2,486,00). The increased valuation largely reflected the fact that there was outline planning permission for a further 19 plots not referenced in the earlier valuation.

c. Assets to be valued fall into different categories. There may be relatively unique assets (e.g. a work of art), with no or few comparables, such that expert opinion may differ very substantially, and the valuation figure must be inherently speculative and fragile. However, where there is an active market with a number of comparables (e.g. residential property), it may not be difficult to provide a secure valuation.

d. GUTHRUM Park is unique

i. EF stated in her third witness statement that "[25.a.] ....Caravan sites can be difficult to source and acquire, and the opportunity to purchase another site similar to GUTHRUM Park, which is close to my other sites and my home ......is not something that could be replicated....... It is not like a house or other property that are easily replaced with like for like (or as good as)."

ii. VAL-L in their 2021 valuation stated, "This is a specialist market".

e. The few "comparables" attached to Appendix 2 of VAL-L's 2021 valuation are in no way comparable to GUTHRUM Park including as they do trading estates and a service station.

f. VAL-L's valuations were carried out during the COVID-19 pandemic. In their 2021 valuation, VAL-L warned that "Our valuations are therefore reported on the basis of 'material valuation uncertainty' as per VPS 3 and VPGA 10 of the RICS Red Book Global. Consequently, less certainty - and a higher degree of caution - should be attached to our valuation than would normally be the case. Given the unknown future impact that COVID-19 might have on the real estate market, we recommend that you keep the valuation of this property under frequent review".

g. The best and fairest way to ascertain the market value of any asset, including land, is by means of a sale on the open market. FPR 25.4 provides that the court may only give permission for expert evidence if "necessary to assist the court to resolve the proceedings". At the Pre-Trial Review hearing, I refused permission for updated valuations because I did not consider them necessary when the Administrators had in April 2023 marketed GUTHRUM Park for sale on the open market.

h. Contrary to the opinion expressed by VAL-L that "the demand for this type of investment is limited", the Administrators' marketing exercise resulted in five offers ranging from £3,300,000 to £5,750,000.

78. Nor do I attach any weight to Mr ZAA's valuation. He is not a court appointed expert and his valuation is non-FPR compliant. Further, his valuation was on a net asset basis, but adopting the net book value of GUTHRUM Park as per the accounts.

79. I do not consider that for present purposes it is necessary for me to fix a specific value of the shares in GUTHRUM at the time of the Share Transfers, but I do find that at that time the shares in GUTHRUM had a substantial value:

a. The Share Transfers were completed in April 2019 prior to the COVID-19 pandemic. GUTHRUM Park was acquired for some £3 million in 2014. It is likely that the value of GUTHRUM Park would thereafter have increased, not decreased, in a rising property market in the 5 year period before the Share Transfers were made, particularly when the site was being developed during that time. In his Form E CD stated that "I had been working and spending money on GUTHRUM... purchased by my mother, brother and myself some 4 - 5 years ago." Further, in his initial written evidence, CD stated that "My role [in the business] was to deal with developing the site, constructing new roads and bases for static caravans on it, groundworks, installation of services and improving generally."

b. Even ignoring GH's offer, the next highest offer received by the Administrators for the GUTHRUM Park site was £3.685 million. Substituting that figure in place of the VAL-L figure of £2.486 million in VAL-C's calculation would result in an adjusted net assets value of £828,504.

c. It is no coincidence that EF and GH have devoted huge resources fighting over control of GUTHRUM Park. GH made an offer of £5.75 million to purchase the site from the Administrators, whilst EF made a counter-offer to re-finance the rescue of GUTHRUM by way of a £4 million inter-company loan. EF and GH then expended significant time and money litigating over which offer the Administrators ought to accept. Whilst there is clearly no love lost between EF and GH, they are very successful business people with vast specialist knowledge of this particular sector. They, more than anyone else, know the true commercial value of GUTHRUM Park.

80. Having determined that the Share Transfers had the consequence of defeating AB's claim for financial relief, it falls upon EF, now supported by CD, to prove that was not the intention and having regard to the fact that the Share Transfers were made less than 3 years before the Section 37 Application was made.

Shares held on trust?

81. It is not disputed that GUTHRUM was incorporated as a special purpose vehicle to acquire and hold GUTHRUM Park.

82. It is EF's case that the Share Transfers were made due to CD's deteriorating health and the need to regularise the ownership position that CD had always held the shares in GUTHRUM on trust for her.

Applicable legal framework

83. EF's Particulars of Claim assert that CD held the GUTHRUM shares "on bare trust for" EF. CD's Amended Defence asserts that EF is the beneficial owner of the GUTHRUM shares pursuant to either (i) "an express agreement", or (ii) "a resulting or common intention constructive trust". Neither statement of case fully particularises the basis of those claims.

84. A bare trust is a form of express trust, whereas resulting and common intention constructive trusts arise by operation of law.

85. There are certain requirements that must be satisfied in order for an express trust to be valid. Snell's Equity (34th ed) summarises the position at para 22-012 as follows:

"If the trust is to operate, its essential elements must be defined clearly enough to enable the trustee, or the court in default, to execute the trustee's duties.

There are therefore three main ways in which an express trust must be sufficiently certain:

(i) the settlor must intend to impose legally enforceable duties of trusteeship on the owner of the property;

(ii) the subject-matter of the trust must be certain; and

(iii) the objects or persons intended to have the benefit of the trust must be certain."